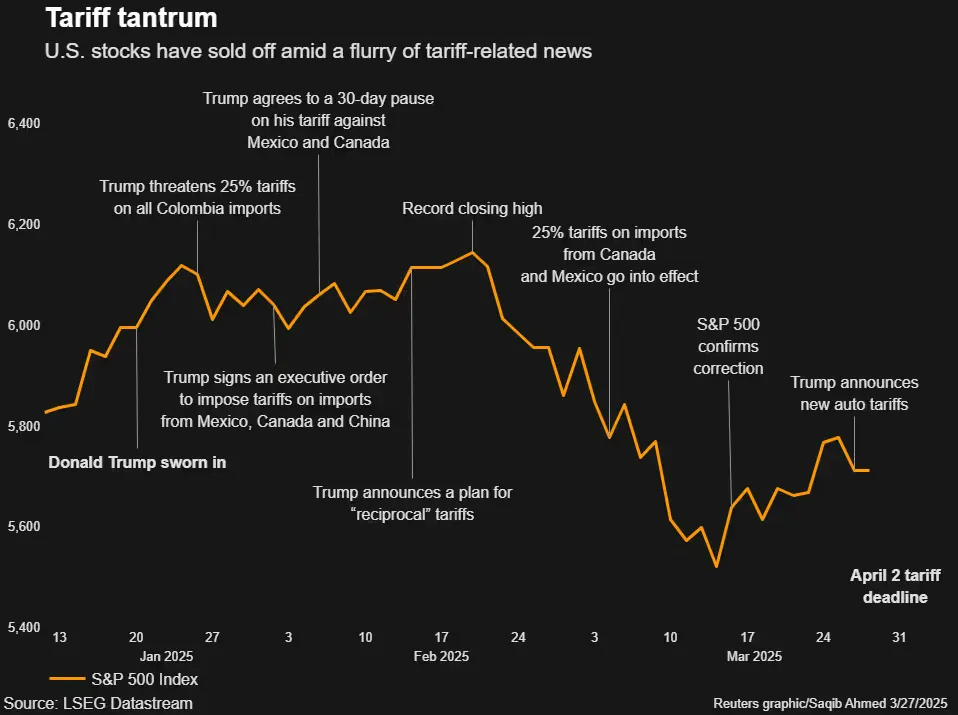

April 1, 2025 — U.S. stock futures are pointing lower as investors prepare for potential volatility in the markets. This comes ahead of President Trump’s anticipated tariff announcements, scheduled for April 2. The new tariffs are expected to significantly impact global trade, with concerns about how they will affect U.S. industries and international relations.

Investors are particularly focused on what the new tariffs might mean for the automotive and tech sectors, which have historically been affected by trade policy changes. The market is bracing for more uncertainty as global economic tensions continue to rise.

At the same time, OpenAI has completed a major $40 billion funding round led by SoftBank, pushing the company’s valuation to an impressive $300 billion. This move highlights the increasing interest in AI and technology companies, despite the ongoing market instability. OpenAI’s funding round is seen as a key indicator of the growing confidence in artificial intelligence ventures, signaling significant investment in the sector despite broader economic concerns.

With these two key developments unfolding, market participants are preparing for a turbulent few days as the economic landscape continues to evolve.